Bank transaction in any mobile

➤check bank balance

➤transfer money to any account

➤Mini Statement

how to use

➤Dial *99# from your mobile handset

➤You will receive a welcome message from NUUP (NUUP- National Unified USSD Payments). Click OK.

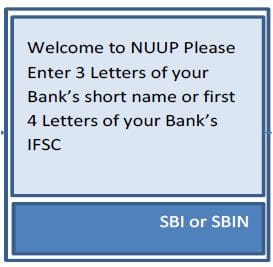

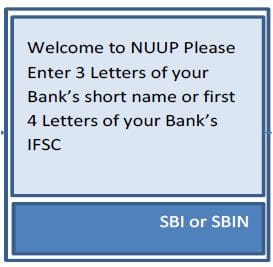

➤Enter either 3 letters of your Bank Short name (or) first 4 letters of your Bank’s IFSC Code (or) 2 digit Direct Code. For example – Short name for SBI is SBI, First 4 letters of IFSC code is SBIN and the 2 digit direct code for SBI Bank is ’41’ (you can Dial *99*41# directly to access your SBI account).

➤You can select respective options for Balance Enquiry, Mini Statement, Fund Transfer, Generate MPIN etc.,

➤check bank balance

➤transfer money to any account

➤Mini Statement

how to use

➤Dial *99# from your mobile handset

➤You will receive a welcome message from NUUP (NUUP- National Unified USSD Payments). Click OK.

➤Enter either 3 letters of your Bank Short name (or) first 4 letters of your Bank’s IFSC Code (or) 2 digit Direct Code. For example – Short name for SBI is SBI, First 4 letters of IFSC code is SBIN and the 2 digit direct code for SBI Bank is ’41’ (you can Dial *99*41# directly to access your SBI account).

➤You can select respective options for Balance Enquiry, Mini Statement, Fund Transfer, Generate MPIN etc.,

How to do Fund Transfer by dialing *99#?

⏩You can transfer funds to your beneficiary account in three different ways using *99# service. The funds will be transferred through IMPS (Immediate Payment Service). Kindly note that the funds will be credited to the beneficiary account instantly. The maximum limit of fund transfer per customer is Rs.5000 per day. (NPCI charges 25 Paise per fund transfer from the remitter bank. Kindly check with your banker about IMPS charges, if any.)

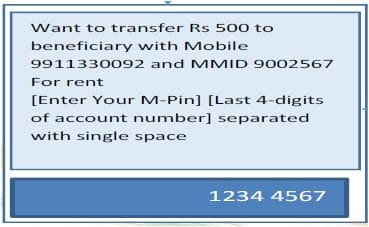

- MMID based :

- Kindly follow the above procedure and select the option ”Fund transfer using MMID’ (Mobile Money Identifier).

- You have to enter the mobile number (10 digit) of the beneficiary, his/her MMID (7 digit), amount and remarks. (One can call his/her bank to know the MMID that has been allotted to him.)

- Enter your MPIN to authenticate this transaction.

- IFSC Code & Bank Account Mode :

- You have to select the option ‘Fund transfer using IFSC code’.

- Enter Beneficiary Account Number, IFS Code (11 digit), Amount and Remarks (Optional).

- Key-in your MPIN to authorize the transaction.

- Aadhaar number based :

- You have to select the option ‘Fund Transfer using beneficiary Aadhaar number’.

- Enter Beneficiary Aadhaar Number.

- Enter your MPIN to authenticate this transaction.

- The beneficiary will then receive the amount to the bank account which is linked to his Aadhaar number.

List of Banks offering *99# service

Kindly click on the below image to download the list of banks offering *99# service. As of now, 51 banks are offering this service. (The banks’ short codes, first 4 letters of IFSC Codes and Direct codes have also been provided.)

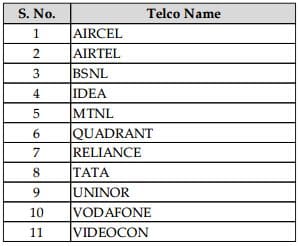

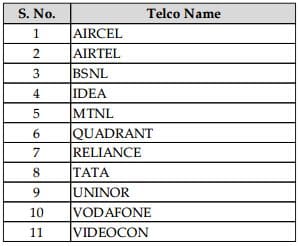

List of Telecom Service Providers offering *99# service

List of Languages supported with Multilingual service codes

Using *99# service through your mobile handset is very easy and convenient. But, do not share your MPIN used for fund transfers with anyone. Else, it can be misused.

Also, note that there is an option to change/generate MPIN in the list of services offered by *99# service. Once can easily generate new MPIN if they have access to your Debit Card. If you lose your mobile, report this to your bank and deactivate mobile banking services immediately.

No comments:

Post a Comment